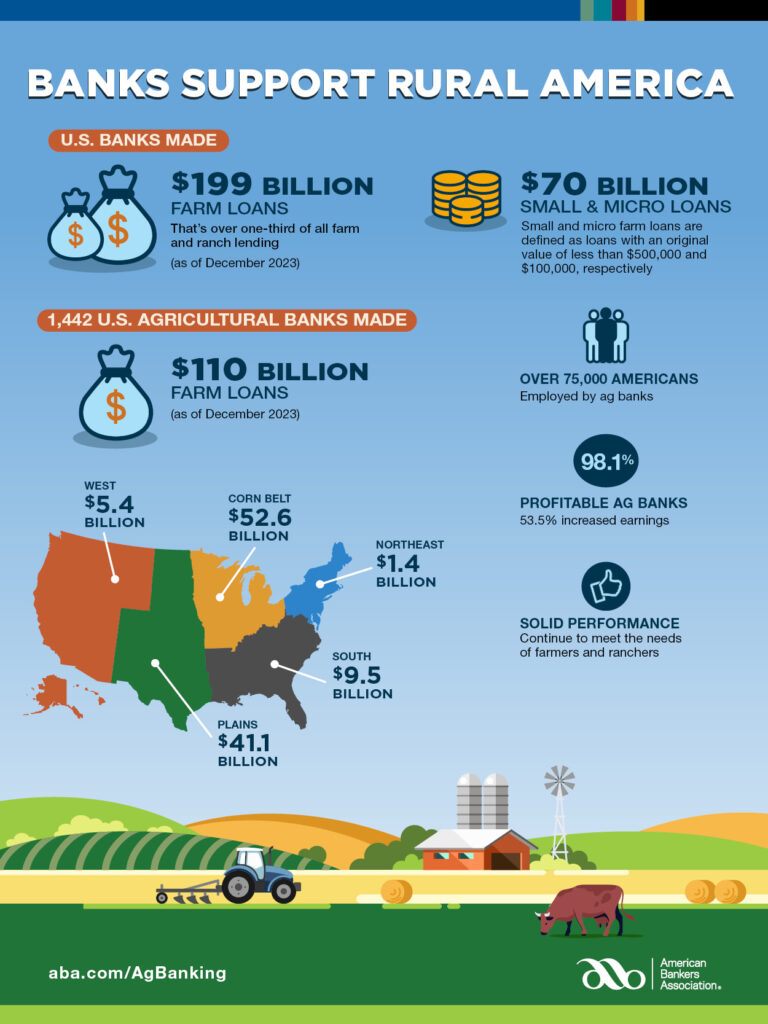

Amid elevated production costs, commodity price volatility, and a return to pre-pandemic levels of direct government payments, agricultural loan demand increased in 2023, and agricultural lending by U.S. commercial farm banks grew 6.7 percent to $110.0 billion, according to the American Bankers Association’s annual Farm Bank Performance Report released yesterday.

This report examines the 2023 performance of the 1,442 banks that specialize in lending to agriculture. Among the key findings:

- The banking industry is the nation’s most important supplier of credit to agriculture, providing over a third (38.1 percent) of all farm loans in the U.S. — $199 billion outstanding as of December 2023.

- Small loans continue to make up over a third (35.4 percent) of banks’ farm and ranch lending, with $70 billion in small and micro-farm and ranch loans on the books at the end of 2023.

- The nation’s 1,442 farm banks recorded strong asset quality and capital levels in 2023 from serving their communities and sticking to traditional banking practices: a focus on the fundamentals of credit, solid underwriting standards, and knowledge of the customer’s business.

- Farm banks have deep roots in their communities. The median farm bank was 113 years old in 2023.

- Farm banks’ asset quality improved in 2023, as measures of loan delinquency remained low by historical standards. Non-current agricultural loans as a share of total agricultural lending (loans 90 days or more past due or in non-accrual status) dropped by two basis points to 0.38 percent in 2023.

- Equity capital — a more conservative form of capital — grew 14 percent, or $5.8 billion, in 2023 for farm banks as a group.

- Employment at farm banks grew by 1.3 percent in 2023, adding 988 jobs and employing about 75,475 rural Americans. Since 2013, employment at farm banks has risen 24.4 percent.

- In 2023, 98.1 percent of farm banks were profitable, with 53.5 percent reporting an increase in earnings.