The United States exported 7.367 billion pounds of broiler meat in 2021. The United States is forecast to export 7.365 billion pounds of broiler meat in 2022, which is almost flat from 2021 and would be 16.3 percent of forecast production, according to USDA’s latest Livestock, Dairy, and Poultry Outlook report.

Broiler production in 2022 was adjusted down slightly, while exports were adjusted up on strong international demand. Whole broiler prices were adjusted up to an average of 148 cents per pound in 2022 on recent data.

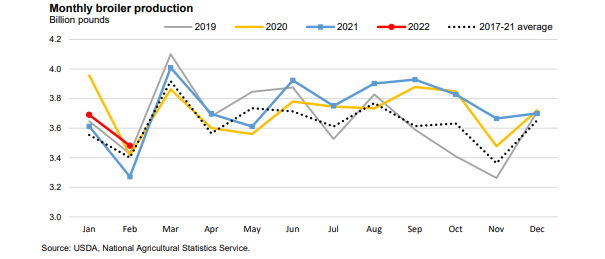

Broiler production in February totaled 3.481 billion pounds, an increase of 6.4 percent year over year. This was a result of increases in both slaughter numbers and bird weights from last February. Preliminary weekly data indicates weaker March production. Based on this, first quarter production was adjusted down to 11.025 billion pounds. The forecasts for the other quarters of 2022 are unchanged at 11.325 billion pounds in the second quarter, 11.625 billion pounds in the third, and 11.225 billion pounds in the fourth. The 2022 total forecast is 45.2 billion pounds, an increase of one percent over 2021.

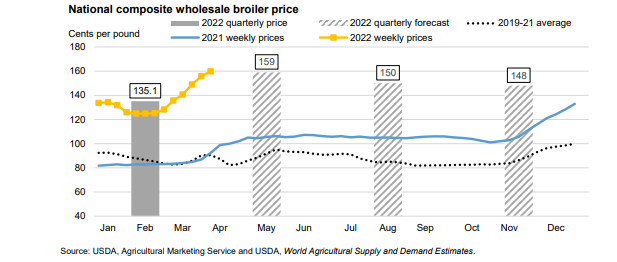

The national composite broiler price averaged 148.04 cents per pound in March, bringing the first-quarter average price to 135.1 cents per pound. Weekly prices continued a climb that started in mid-February, averaging 159.81 cents per pound in the week ending April 1st. Expectations are that the composite price will remain elevated thanks to strong demand and relatively slow growth in production. Quarterly price projections for 2022 were adjusted up accordingly, to 159 cents per pound in the second quarter, 150 cents in the third quarter, and 148 cents in the fourth quarter. This would lead to an annual average of 148 cents per pound, 47 cents over last year’s average of 101.2 cents.

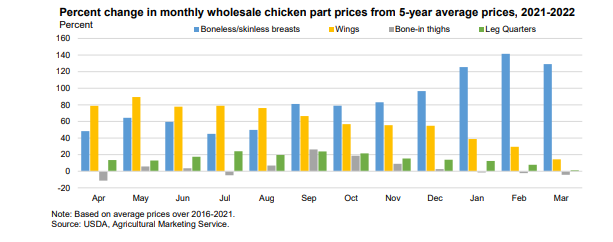

The recent upswing in the national composite price is not reflected in wholesale prices for chicken parts. The chart below compares the last 12 months of wholesale prices to the previous five year average for boneless/skinless breasts, wings, leg quarters, and bone-in thighs. Boneless/skinless breasts are in high demand domestically as the pandemic weakens and the restaurant industry ramps up, and the recent elevated prices reflect that. The wholesale price averaged 277.55 cents per pound in March, a new record high. Wholesale prices for wings remain elevated relative to pre-pandemic levels, but they have been falling steadily since last summer. Wing prices averaged 223.14 cents per pound in March. Bone-in thighs are less labor intensive than boneless products and were likely more available than boneless thighs. Their prices didn’t climb during the pandemic as those for some other parts did, averaging 61.03 cents per pound in March. Leg quarters have strong export demand, and while prices fell in 2020, they have been relatively stable since. Prices averaged 38.62 cents per pound in March.

The full report can be viewed here.

The full report can be viewed here.