USDA/ERS adjusted the outlook for this year’s broiler production by 260 million pounds, ready-to-cook weight, from lasts month’s projection of 45.225 billion pounds, citing slow output since the beginning of the year, lagging recovery in hatchability rates, and expectations of higher feed costs for the remainder of the year combining to cause this revised outlook, according to the agency’s Livestock, Dairy, and Poultry Outlook report this week.

Broiler production totaled 3.688 billion pounds in January, two percent above last year. This increase was a result of both stronger average weights (0.6 percent higher than last January) and an extra slaughter day compared to last year. Per day slaughter was below January 2020 and 2021 levels by 3.5 percent.

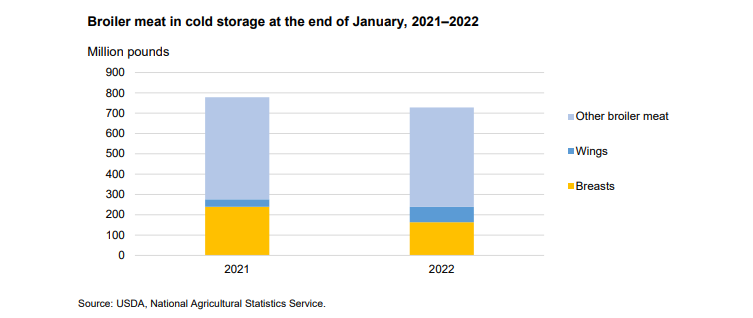

Broilers in cold storage remained historically low, ending January at 728 million pounds. This is 6.5 percent below last-January levels and 12.9 percent below the 2019-21 average January levels. Chicken wings in cold storage climbed from 36.7 million pounds at the end of January 2021 to 75.6 million pounds at the end of January 2022, accounting for 10.4 percent of total broiler meat in cold storage. Breast meat in cold storage declined from 239.3 million pounds in 2021 to 163.5 million pounds at the end of January 2022, making up 22.5 percent of frozen broiler meat. Projected broiler ending stocks were adjusted down by 10 million pounds to 745 million pounds.

Based on low January exports as well as decreased production expectations and higher forecast prices, 2022 broiler exports were adjusted down by 70 million pounds to 7.305 billion pounds, a year-over-year decrease of about one percent. This would represent about 16 percent of projected 2022 production.

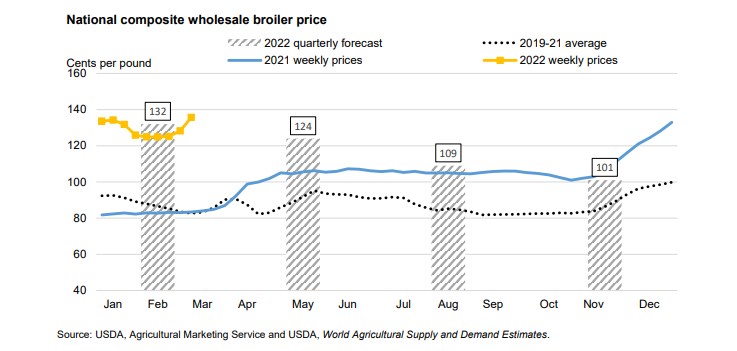

The national composite broiler price averaged 125.79 cents per pound in February, about 43 cents above last February. Weekly prices have begun a seasonally-typical swing upwards, averaging 135.67 cents per pound in the week ending March 4th. The first-quarter forecast price is increased by 5 cents to 132 cents per pound on this upswing, and the prices in the outlying quarters were increased on tighter supply expectations. This brings the 2022 average price forecast to 116.5 cents per pound, 15 cents over the 2021 average.

Wholesale prices for boneless chicken parts remain high. While boneless/skinless thigh prices have declined from the 2021 peak, they averaged 162.01 cents per pound in February, 78 cents above the same month a year ago. The average boneless/skinless breast prices reached a record high 264.45 cents per pound for February, nearly double the year-ago price.

USDA’s report can be viewed here.