Broiler production forecast for 2022 was adjusted down from the previous forecast but is still expected to increase by 2 percent over 2021, according to USDA’s Livestock, Dairy, and Poultry Outlook report.

Broiler ending stocks were lower than expected at the end of 2021, so 2022 ending stocks were also revised down. Broiler export forecast was revised down in 2022 but is still expected to increase slightly from the 2021 total. The annual average broiler price forecast was adjusted up by one cent in 2022 on higher expected feed costs.

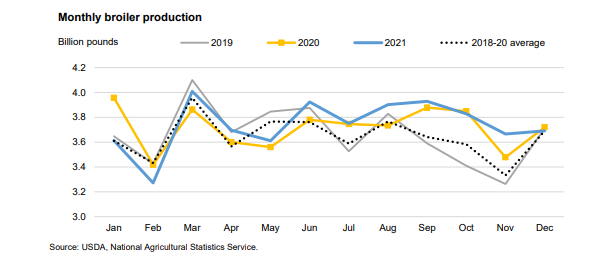

December broiler production totaled 3.691 billion pounds, a decrease of less than one percent from last December. This was a result of slight year-over-year declines in both head slaughtered and average live weights. Total 2021 production is estimated at 44.890 billion pounds, an increase of less than one percent from 2020. Based on weak preliminary January slaughter data and winter weather that caused multi-day plant shut-downs in early February, the first-quarter production projection was adjusted down by 100 million pounds to 11.15 billion pounds. The outlying quarters of 2022 were adjusted down as higher forecast feed costs temper growth. Total projected production for 2022 is 45.485 billion pounds. This would be a year-over-year increase of just over one percent from 2021.

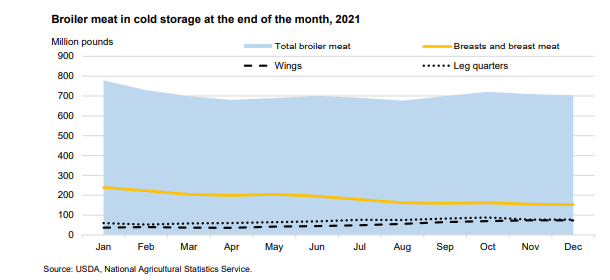

Broiler meat in cold storage fell to 704 million pounds at the end of December as production failed to keep pace with demand. This is a slight decrease from the end of November and 15 percent less than the end of 2020. Breast meat in particular saw a decline in cold storage stocks at the end of 2021, 104 million pounds lower than the end of 2020. Only chicken wings and leg quarters have seen increases in cold storage levels since the end of 2020, but these parts represent a small share of broiler meat in cold storage. With continued slow growth in production in 2022, projected broiler meat in cold storage at the end of 2022 was adjusted down by 30 million pounds to 755 million pounds.

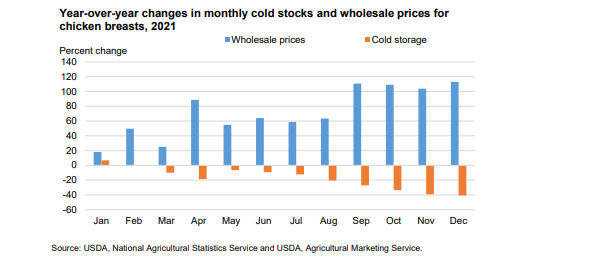

Weekly national composite wholesale broiler prices ended an 11-week climb in January, peaking at 134.21 cents per pound in the week ending January 14th. January prices averaged 131.39 cents per pound, a year-over-year increase of 49 cents. However, prices declined from their peak and by the first week of February averaged 124.88 cents per pound. Based on recent prices, the first-quarter broiler price forecast was adjusted down by 1 cent to 127 cents per pound. The outlying quarterly price forecasts were adjusted up to 120 cents per pound in the second quarter, 106 cents in the third, and 98 cents in the fourth. This brings the 2022 average to 113 cents per pound, an increase of 12 cents over last year’s average. Some of the most high-demand chicken parts are wings and breasts. Breast meat can be found in sandwiches in various fast-food establishments, and chicken wings are popular additions to major sporting events such as the Super Bowl and March Madness. Rising wholesale prices for these parts has coincided with low levels in cold storage. Chicken breast meat in cold storage fell from 239 million pounds at the end of January 2021 to 152.6 million pounds at the end of December, a year-over-year decrease of 41 percent from the end of December 2020. In 2021, wholesale prices for boneless/skinless chicken breasts averaged 72 percent above year-earlier levels. The January average wholesale price for boneless/skinless breasts was 230.98 cents per pound, 122 cents above last January, the highest price since this climb began.

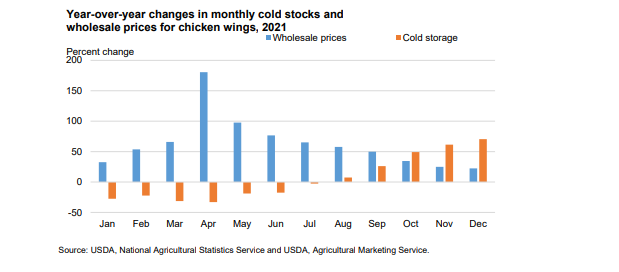

For chicken wings, the story is similar. The largest year-over-year increase in wholesale wing prices was in April, coinciding with the largest year-over-year drop in cold storage levels. While wing stocks have recovered, the wing prices decreased but they are still well above year-ago levels. In January, wing prices averaged 267.93 cents per pound, an increase of 24 cents year[1]over-year, but down 49 cents from the 2021 peak.

USDA’s full report can be viewed here.

USDA’s full report can be viewed here.