The broiler production forecast was increased in the fourth quarter on strong preliminary slaughter data and positive placement data. Broiler export forecasts were also increased in the fourth quarter and for 2022, according to USDA’s Livestock, Dairy, and Poultry Outlook. Broiler price forecasts were increased in the fourth quarter and the first half of 2022 on recent price trends.

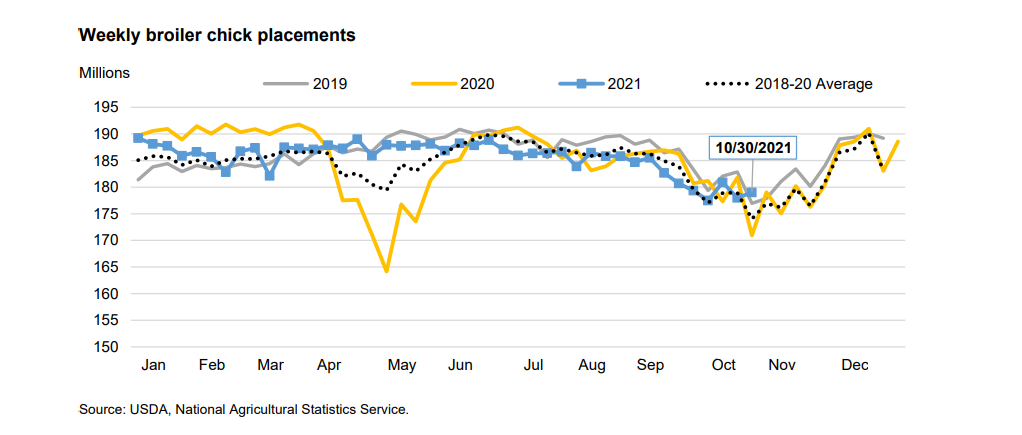

September broiler production totaled 3.927 billion pounds, a year-over-year increase of 1.3 percent. While slaughter was only about half a percent up from the year before, the average live weight increased by almost one percent year-over-year. Third-quarter production totaled 11.579 billion pounds, a two percent increase from 2020. Chick placements were up six percent year-over-year in the week ending October 30th, the largest increase since May, when year-over-year comparisons were still skewed by the COVID-19-related disruptions in 2020.

While weekly egg sets have averaged about four percent above 2020 levels since April, weekly broiler placements have trended at or below 2020 numbers. Based on this stronger placement data and preliminary October production data, the fourth-quarter production forecast was increased by 25 million pounds to 11.125 billion pounds. This would bring annual production to 44.828 billion pounds, an increase of almost one percent over 2020 production. The production forecast for 2022 is unchanged at 45.240 billion pounds, one percent growth over the 2022 forecast.

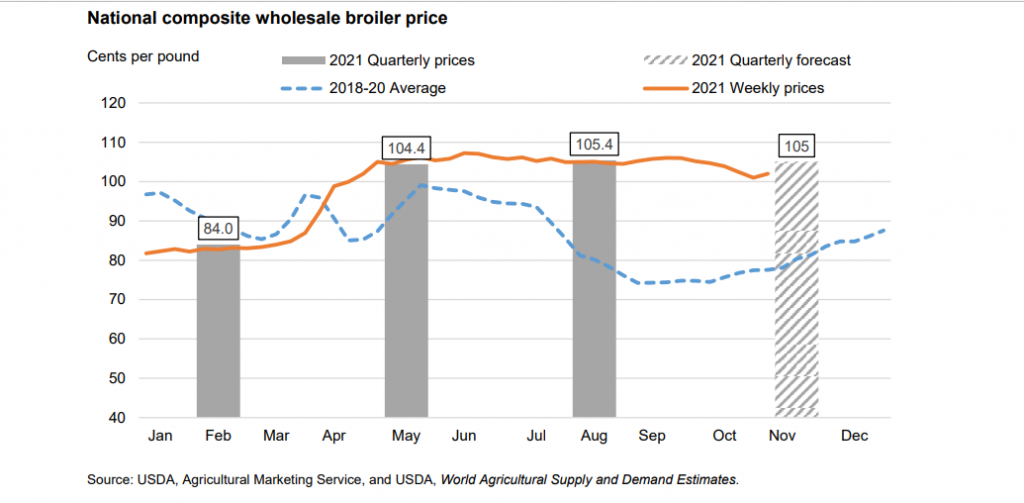

October broiler prices began to gradually decline from their steady levels in the third quarter, averaging 102.95 cents per pound and reaching a low of 100.98 cents per pound in the week ending October 29th. Prices bounced back to an average of 102.02 cents per pound in the first week of November. Based on expectations of a seasonal upswing in prices in the last months of the year, the fourth-quarter forecast was adjusted up by 5 cents to 105 cents per pound. Forecast prices for 2022 were adjusted up to 105 and 106 cents per pound in the first and second quarters, respectively, making the 2022 annual average forecast price 99 cents per pound.

While wholesale prices for broiler parts remain elevated from last year, they declined in October from September levels. Boneless-skinless breast prices declined by 11 percent month over month to 186.5 cents per pound. This is still more than double last October’s price. Wholesale prices for chicken wings declined by six percent from September, averaging 293.9 cents per pound in October. This is 35 percent above last year. Chicken tender prices also declined by 10 percent month over month, averaging 270.67 cents per pound in October, 78 percent above October of last year.