Total broiler production was adjusted down slightly in both 2021 and 2022, with one percent growth expected in 2022. Broiler exports were adjusted up in the third quarter on strong August shipments. Broiler prices were adjusted up on recent data, according to USDA’s October Livestock, Dairy, and Poultry Outlook report.

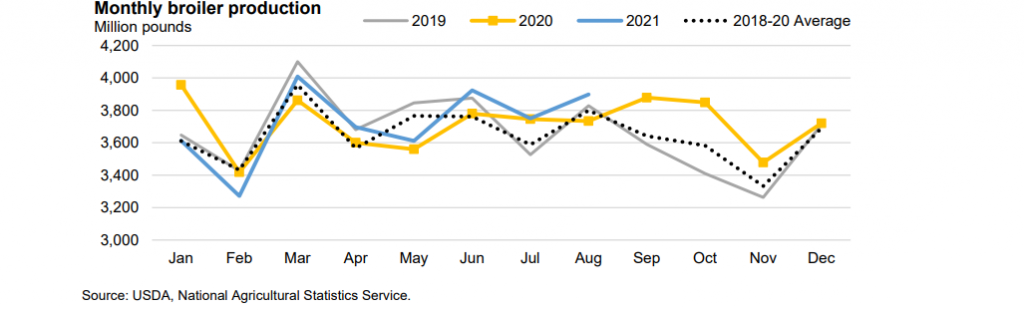

August broiler production totaled 3.898 billion pounds. Both slaughter numbers and average live weights were higher than August of last year, although the slaughter increase reflected an additional slaughter day in 2021. Based on strong August production, the third-quarter production forecast was adjusted up by 50 million pounds to 11.5 billion pounds. However, as weekly chick placements remain below last year’s levels, forecast fourth-quarter production was decreased to 11.1 billion pounds. These adjustments bring the 2021 annual forecast to 44.724 billion pounds, a fractional increase from 2020. The 2022 forecast was adjusted down slightly to 45.24 billion pounds, representing one percent growth over 2021.

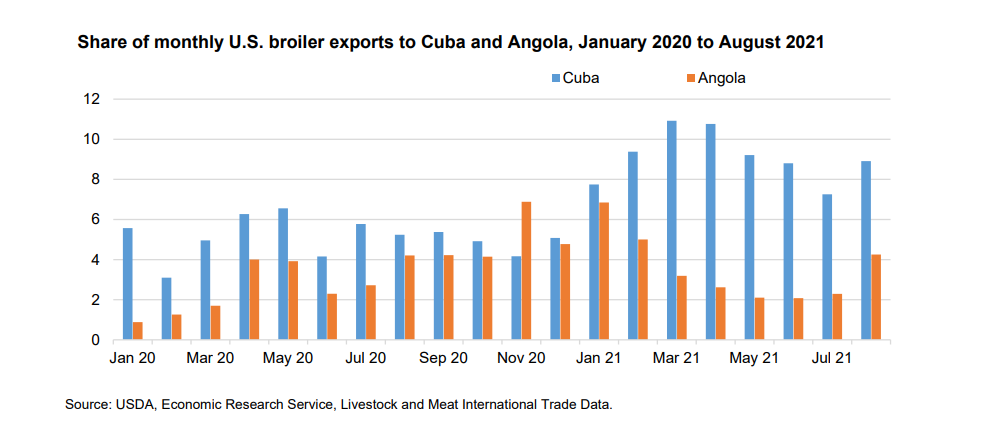

August broiler exports totaled 650.4 million pounds, an increase of six percent over last August and more than 50 million pounds more than exported in the previous month. The increase was accounted for by strong shipments to Mexico and several extremely variable markets, including Cuba and Angola. Combined, these two countries accounted for 8.5 percent of U.S. broiler exports in 2020. In January through August 2021, they have accounted for a 12.7 percent share of broiler exports. Forecast third-quarter exports were adjusted up to 1.84 billion pounds on strong August shipments. The export forecast for the fourth quarter is unchanged, as is the forecast for 2022. The annual broiler import forecasts were adjusted up to 150 million pounds in 2021 and 145 million pounds in 2022.

September national composite whole broiler prices averaged 105.75 cents per pound, bringing the third-quarter average price to 105.4 cents per pound. Weekly prices have held steady at close to 105 cents per pound since mid-May, bypassing the seasonally typical decline in prices through the second and third quarters. The fourth-quarter broiler price forecast was adjusted up to 100 cents per pound on continued firm demand and slower growth in production. This would make the 2021 annual average price 98 cents per pound. Price forecasts for 2022 were also adjusted up, making the annual average price forecast 98 cents per pound.

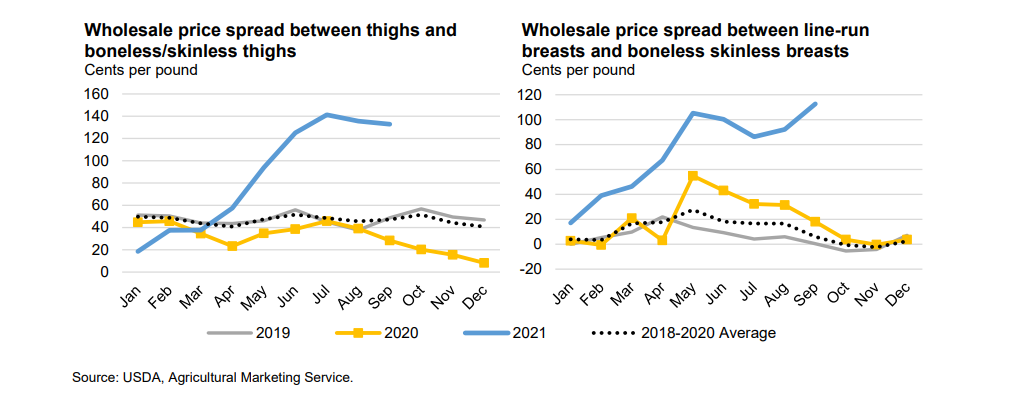

Wholesale prices for many chicken cuts remain elevated. However, boneless skinless cuts are even higher, as they require additional labor to process. When more thighs and breasts with skins and bones are available relative to those without, the spread between the prices increases. The spread between wholesale prices for thighs and boneless skinless thighs began to climb in April of this year, and by July it was nearly triple the 3-year average. For chicken breasts, the spread between the line-run price and the boneless/skinless price jumped to 55 cents in May of 2020 when poultry plants were facing major disruptions due to the pandemic. The spread fell through much of 2020, but climbed again in 2021; in September it is about six times the average spread in 2020.