First-quarter broiler production forecast was lowered at 3.27 billion pounds, a year-over-year decrease of 4.3 percent, while the second-quarter production forecast was increased on hatchery data. The broiler export forecast and price forecast were unchanged.

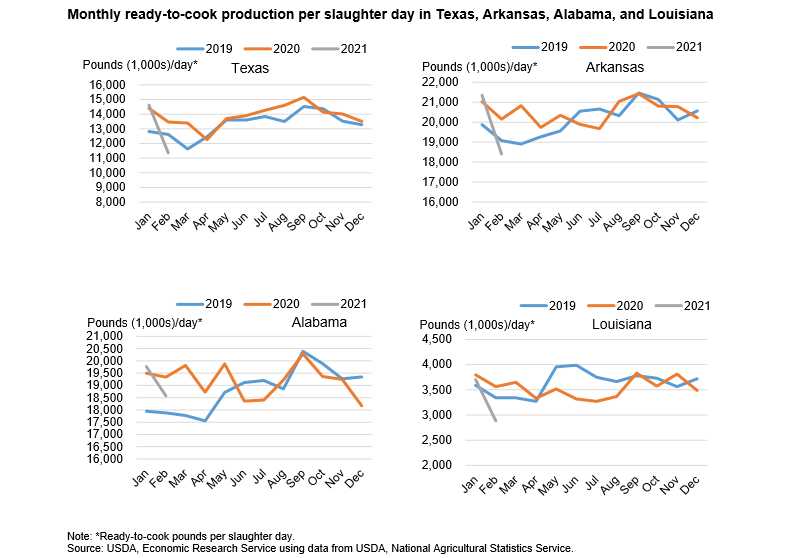

The decline can largely be attributed to winter and ice storm disruptions in mid-February that impacted broiler production in the Southern States, particularly Texas, Arkansas, Alabama, and Louisiana, among others (see charts). Despite industry reports of increased shifts and weekend slaughter to make up for the loss in output, ready-to-cook production on a per slaughter-day basis dropped off markedly relative to January as well as to year-earlier levels in these States. Further, preliminary slaughter data for March points to a year-over-year decrease in slaughter volumes. As a result, the first-quarter production estimate was lowered to 10.90 billion pounds.

Second-quarter production forecast was increased to 11.18 billion pounds based on expectations for higher year-over-year slaughter in April, along with more birds available for slaughter in May and June. Even with the lower egg sets in January and chick placements in February year over year, April slaughter is expected to be higher year over year given that April 2020 slaughter volumes were significantly impacted by the onset of COVID-19-related market disruptions. Further, recent hatchery data point to more birds available for marketing into May and June. Production in 2021 is forecast to total 44.780 billion pounds, a year-over-year gain of less than one percent.

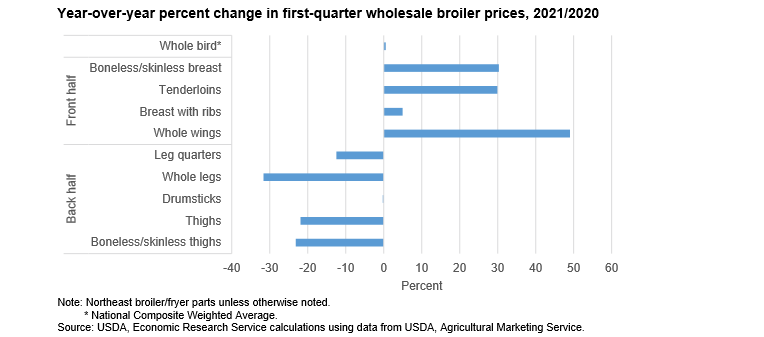

March wholesale broiler prices (National Composite Weighted Average) continued to trend higher year over year for the second consecutive month, averaging 86.7 cents per pound or 9.2 percent higher relative to last year. First-quarter broiler prices averaged 84 cents per pound, an increase of 0.6 percent year over year (see chart). The forecasts for the outlying quarters are unchanged.

As mentioned in January’s 2021 issue of the Livestock, Dairy, and Poultry Outlook report, 2020 wholesale broiler prices were down year-over-year across the board, with the exception of wings and drumsticks. In the first quarter of 2021, however, parts from the front-half of the bird have strengthened, while the back half continued to wane relative to last year. In particular, first-quarter whole wing (Northeast) prices increased 50.3 percent year-over-year, while boneless/skinless breasts and tenderloins increased 30.3 percent and 29.9 percent, respectively.

The continued strengthening of wing prices can be attributed to generally tight supplies (stemming from labor challenges), as well as to strong domestic demand for wings. After depressed boneless/skinless (b/s) breast prices for much of the last few years, wholesale b/s breast prices strengthened significantly in the first quarter, in part due to increasing demand, particularly a result of the ongoing chicken sandwich wars. Conversely, prices for parts from the back half of the bird were lower year-over-year, especially whole legs (-31.6 percent), b/s thighs (-23.1 percent) and thighs (-21.9 percent).

USDA’s April issue of the Livestock, Dairy, and Poultry Outlook report can be viewed here.