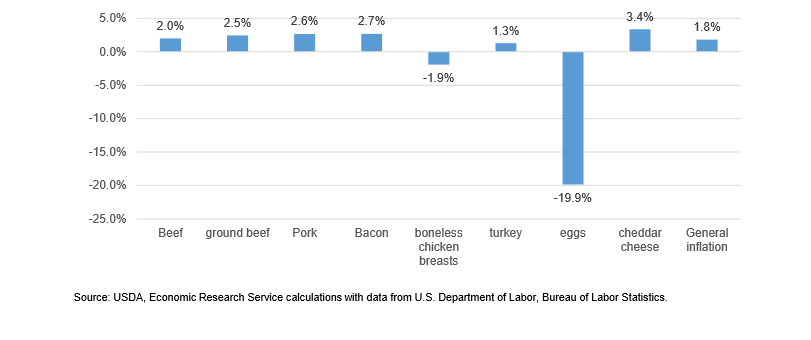

The U.S. Department of Labor Bureau of Labor Statistics, in mid-January, released estimates of the retail prices for selected animal products and the consumer price indexes (CPIs), according to USDA’s Livestock, Dairy, and Poultry Outlook report. The CPI measures price inflation.

Using 1982-84=100, the overall CPI was 251.1 in 2018 and 255.7 in 2019, a 1.8-percent increase. The figure below shows the percent increase in prices for beef, ground beef, pork, bacon, boneless chicken breasts, turkey, eggs, and cheddar cheese. All of the prices for red meat and cheddar cheese increased more rapidly than inflation.  Broiler production forecast for 2020 was revised up on current chick placement data, and on continued growth in the broiler breeding flock. 2020 ending stocks were revised down on lower beginning stocks, while the first-quarter price forecast was revised up on recent price movements. The 2020 egg (table and hatching) production forecast was increased on table egg layer flock and lay rates, as well as expectations for increased broiler production. The ending stocks forecast was revised upward on higher beginning stocks, while the price forecast was increased on recent price movements.

Broiler production forecast for 2020 was revised up on current chick placement data, and on continued growth in the broiler breeding flock. 2020 ending stocks were revised down on lower beginning stocks, while the first-quarter price forecast was revised up on recent price movements. The 2020 egg (table and hatching) production forecast was increased on table egg layer flock and lay rates, as well as expectations for increased broiler production. The ending stocks forecast was revised upward on higher beginning stocks, while the price forecast was increased on recent price movements.

Broiler production for December was estimated at 3.6 billion pounds, a year-over-year increase of 7.2 percent when adjusted for slaughter days. Slaughter numbers increased by 4.2 percent (adjusted for slaughter days), while average weights increased by 2.5 percent. Total 2019 production amounted to 43.9 billion pounds, a year-over-year increase of 3 percent. Birds slaughtered totaled 9.2 billion (a year-over-year increase of just over 2 percent), while aggregate average live weights reached 6.32 pounds. This 1-percent increase in bird weights was due to an increasing share of heavy-bird production (i.e., of birds weighing more than 6.25 lbs), which increased by 2.4 percentage points in 2019.

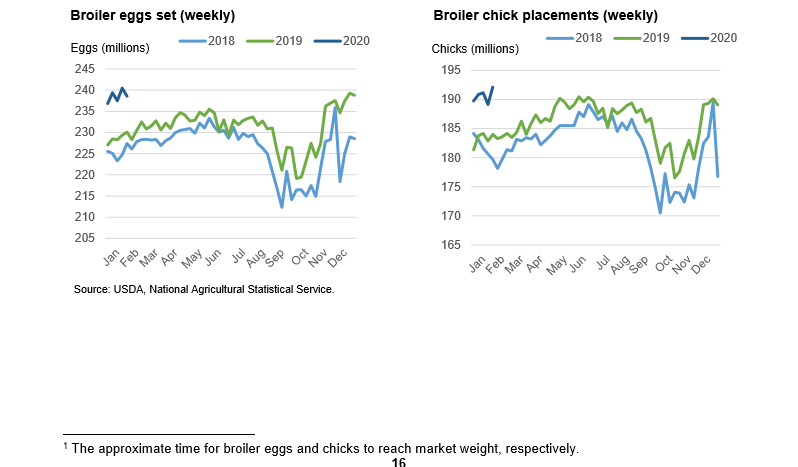

Preliminary weekly slaughter data point to continued year-over-year increases in slaughter and average live weights in January. Additionally, eggs set and chick placements have been trending higher year over year (chart below), averaging increases of 4.9 percent and 4.5 percent over the past 10 and 7 weeks,1 respectively, suggesting a larger-than-previously-expected number of birds available for marketing in the coming months. Furthermore, the broiler layer flock continues to be higher relative to last year. Based on more birds available for slaughter thus far in the year and an increasing broiler layer flock supporting increased broiler availability, the 2020 production forecast was increased to 45.8 billion pounds, more than 4 percent over 2019 production.

December ending stocks are estimated at 921 million pounds. Although 2019 ending stocks came in lower than expected—partly due to an 11-million-pound downward revision to November ending stocks —the December 2019 ending inventories represent the highest year-end stocks to date. Of the 76.8 million pounds added to cold storage since the beginning of the year, other broiler meat represented 46 percent, while breast meat, leg quarters, and thigh meat represented 37, 26, and 18 percent, respectively. Anticipated increases in broiler supplies in 2020 are expected to continue weighing on cold storage inventories; however, given that 2020 stocks started out lower than expected, the 2020 ending stocks forecast was revised down to 915 million pounds. The whole bird (National Composite) wholesale price averaged 90.56 cents per pound in January, 8.4 percent lower year over year and 2.8 percent lower than the 5-year average. Despite the benchmark price being down in January, recent price movements exceeded expectations, which was the basis for increasing the first-quarter price forecast to 89 cents per pound. The outlying quarters remain unchanged.