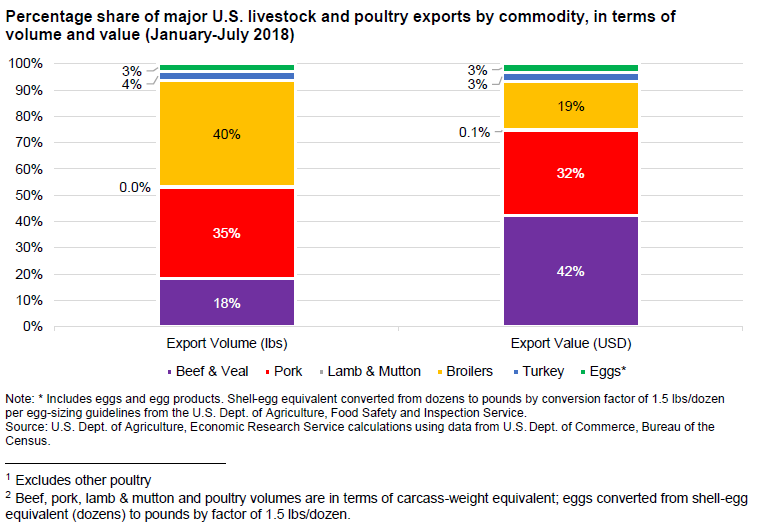

Year-to-date 2018 exports of beef, pork, lamb, poultry, and eggs amounted to 10.1 billion pounds, valued at $9.8 billion, according to USDA’s latest Livestock Dairy and Poultry Outlook report.

In terms of volume, broiler exports represented the largest share (40 percent) of total exports, followed by pork (35 percent), beef and veal (18 percent), turkey (4 percent), eggs (3 percent), and lamb (less than 1 percent). In comparison, the distribution of value shares is more or less equal for all commodities, except for broilers and beef. As depicted in the chart below, beef and veal represent the largest share (42 percent), followed by pork (32 percent), broilers (19 percent), turkey (3 percent), eggs (3 percent), and lamb (less than 1 percent).

Broiler production projections were not revised, while price projections were decreased for the remainder of 2018 and 2019 on recent price trends and increasing probability of competition across meats. Projections for egg production were revised down slightly for the remainder of 2018 on recent production indicators, while prices were revised down for the third quarter only, on recent price declines just before September.

July broiler production was 3.6 billion pounds, 2.4 percent higher than a year earlier after adjusting for 1 more slaughter day this year. Growth was the result of average live weights up 1.0 percent from last year and more birds slaughtered.

As of August 1, a reduction of 1.0 percent of the breeder inventory from the previous month left 58.2 million birds, reflecting a seasonal decline typically associated with reduced temperatures and expectations for seasonally weaker broiler meat demand later in the year. The rate of decline has occurred faster than normal, most likely related to dynamics occurring within the breeder flock.

Inventory levels this year have been at elevated levels to compensate for lower breeder productivity, including fewer eggs per layer and fewer of those hatching than in previous years. This year, first-of-the-month inventory has averaged 4 percent higher year-over-year, double the average growth rate for 2013-17.

Recent breeder productivity has recovered by attaining faster-than-normal growth in eggs per layer. June-July eggs produced per 100 birds this year were much closer to the average of the previous 5 years than earlier months. As a result, breeder inventory declines have been partly offset and it is expected that producers will manage inventory levels with reference to breeder productivity. With these largely offsetting changes, projected broiler production was not revised, with growth expected at 2.3 percent for 2018 and 1.9 percent for 2019.