Argentina’s poultry sector consists solely of chicken production. The Argentine chicken production sector is largely comprised of domestic, family-owned enterprises with negligible foreign investment.

Nevertheless, investment amongst the domestic players in greater vertical integration in the Argentine poultry sector has resulted in plant and equipment modernization that is producing gains in product efficiency, quality, standardization and tighter traceability, based on a USDA GAIN report.

Over 80 percent of the country’s chicken meat production is processed in 58 federally inspected plants. The remaining production is attributed to smaller companies whose production is approved and controlled by provincial authorities for local sale only.

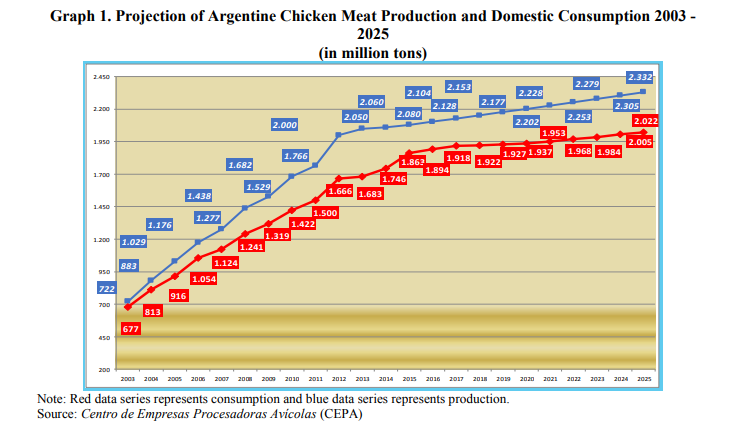

Post forecasts 2019 chicken meat production as stable at 2.18 million metric tons (MMT) as stagnant domestic consumption dominates forecast export growth. As domestic demand has historically consumed approximately 90 percent of the Argentine chicken meat production, domestic preferences and purchasing power are highly influential factors in production decisions. Consumption has remained flat since 2012 (see graph 1). High inflation and stagnant real wages are expected to temper demand in the near future due to a continuing loss in consumer purchasing power. Production gains attributable to exports remain modest due to economic and supply challenges for Argentine producers. (see Trade

section below).