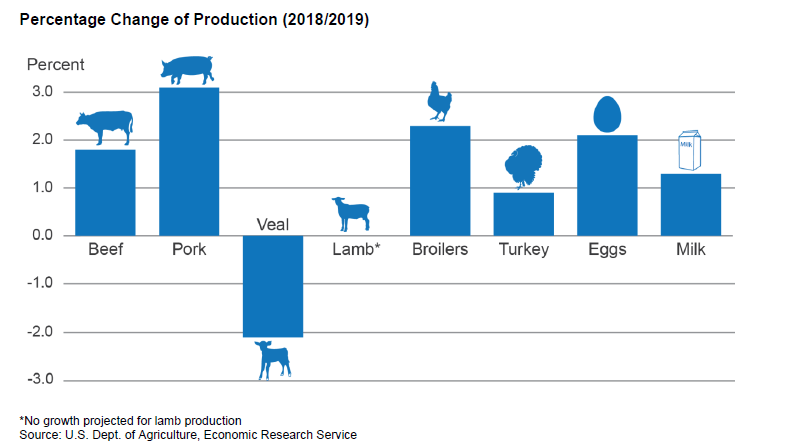

USDA production forecasts for 2019 indicate growth expectations for broilers (+2.3 percent), beef (+1.8 percent), pork (+3.1 percent), turkey (+0.9 percent), eggs (+2.1 percent), and milk (+1.3 percent). Conversely, veal production is expected to decrease by 2.1 percent, while no growth is projected for lamb.

Compared to average annual growth rates for 2014-2018, 2019 forecasts for beef and turkey are projected to see higher growth than the 5-year averages of 1.2 percent and 0.4 percent, respectively. Pork, broilers, and eggs are expected to be about on pace with 5-year average growth rates of 3 percent, 2.3 percent, and 1.9 percent, respectively. The forecast growth rate for milk production is down from the 5-year average of 1.7 percent, according to USDA latest Livestock, Dairy, and Poultry Outlook.

Over the 2014-2018 period, veal production contracted notably, averaging annual decreases of 8.1 percent, but recent years and the 2019 forecast indicate a slowed rate of contraction. Similarly, in 2019, lamb, which had average annual declines of 1.3 percent over the past 5years, is expected to maintain production levels consistent with 2018.

Some broiler hatchery challenges have remained, while heavier birds and announced facility construction drive 2018/2019 production projections. Broiler prices are currently strong, as reflected in upward revisions to 2018 projections. Table egg hatchery data confirmed expansion intentions, while recent egg prices declined seasonally, then reverted to more normal levels. Turkey production is expected to decline in 2018 and increase only marginally in 2019 as producers work to counter historically low prices and rising stocks in cold storage.

Broiler hatchery data has continued to suggest some challenges in expanding production. Estimated eggs hatched per layer in the first quarter of 2018 were down 2.8 percent from last year. While a larger inventory of layers more than compensates for the reduced hatching rate, slaughter data also reflects some production setbacks. In March, birds slaughtered were only about 0.6 percent above a year earlier (on a per slaughter day basis).

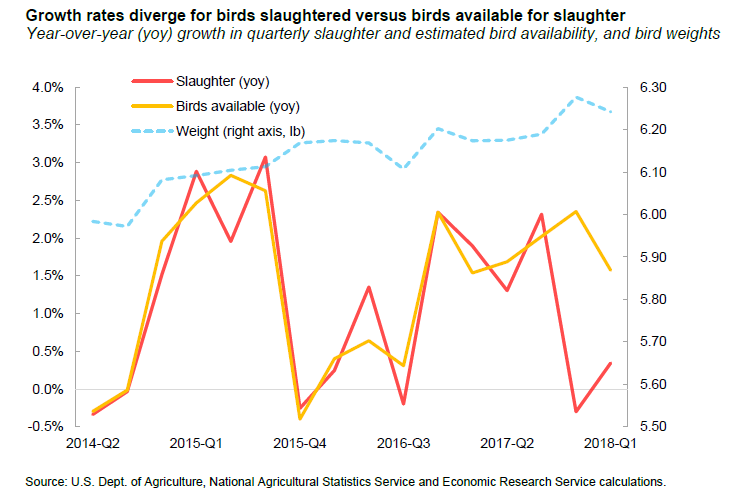

Recent growth in bird slaughter was less than would be expected from birds available in growing operations. The figure below compares growth rates for broiler slaughter with growth estimates for birds placed in growing operations 6-7 weeks earlier (assumed to be mature and available for slaughter). Until recently, these series had only small differences, which often balanced out in succeeding quarters. Recent bird slaughter growth fell behind the increase in birds available in the last two quarters (fourth-quarter 2017 and first-quarter 2018), with shortfalls of 2.7 and 1.2 percentage points, respectively.

This recent slowing in the slaughter rate reflects producers growing birds longer—and thus heavier than they would be otherwise. Substantial weight increases in the last two quarters returned weights to the more normal growth trend that had been interrupted during the prior year. By slaughtering birds at heavier weights, producers can offset expected restraints on growing more larger-sized broilers due to downward trends in hatching rates and lags that delay expansion of the breeding layer inventory.

Although the first-quarter production estimate was raised to reflect March data, projections for the outlying quarters of 2018 are not revised and annual production growth is forecast at 1.6 percent. Production for 2019 is forecast at 4.34 billion pounds, a 2.3-percent growth rate. In addition to a response to higher prices in 2018, higher 2019 growth is based partly on announcements of new production facilities that are expected to be operating in 2019.