The monthly World Agriculture Supply and Demand Estimates (WASDE) report for August held a number of interesting projections for the poultry industry, according to Dave Juday, principal, The Juday Group and NCC consultant.

The headline news was the adjustment to the corn projections, which is particularly significant because this is the first of USDA’s monthly reports to be based on survey data. Corn yields, after a near perfect growing season, are projected to be 167.4 bushels per acre, which is up 2.1 bushels from the previous trend line estimates. That would boost projected corn production of 2014-15 to 14.032 billion bushels, and bring total supply up to an estimated 15.243 billion bushels. Based on that projection, USDA is lowering the season average corn prices by 10 cents per bushel at both ends of its range to an estimated $3.55 to $4.25 per bushel. Based on lower prices, USDA is projecting feed and residual use up 50 million bushels, along with ethanol use and exports both up 25 million bushels each.

Based on lower feed costs, USDA raised total meat production as it expects lower feed costs to boost cattle, hog, and broiler weights. USDA also projects increased broiler numbers as producers increase birds more rapidly than previously forecast. Broiler production for 2014 was raised 166 million pounds, versus a combined 44 million pounds for red meat and a six million pound reduction in turkey production. Export projections for broilers, however, were reduced for both 2014 and 2015 due to the impact of the Russian import ban, which is expected to have some price impact for the rest of this year. USDA lowered the 2014 price forecast range for broilers by $2 to $3 per hundredweight to $103-$106 from $106 to $108 but left the 2015 outlook unchanged at $100 to $108.

There is another aspect to this year’s expected bumper corn crop for poultry producers to consider: the impact on propane. Last year’s large corn crop coupled with severe winter weather and infrastructure bottlenecks created a costly propane shortage for the poultry industry. That has heightened attention to this year’s market situation.

A record corn crop – especially this year’s crop, which is likely to have a higher moisture content, will increase the demand for propane for grain drying. Ultimately, this year’s propane demand will depend on fall weather patterns and harvest timing. If impending weather forces the crop to be harvested quickly, the demand could surge. If good weather drags out the harvest until the end of the year, the peak in demand is delayed. But either way, this summer has not had the high degree days that help dry moisture content in the corn, meaning more drying may be needed.

The primary driver of propane is heating use in the winter, thus any expectations of another cold winter with the current crop demands for drying could be very bullish for propane. Typically the market in the Midwest builds propane supplies from April through September, with the draw-down starting with October harvest time and corn drying, through the winter weather heating use period which extends through March. The positive news is that near the end of that six month seasonal build up, inventories in the Midwest are up about 1.9 million barrels over last year. As of August 8, 2014, the total days-of-supply in storage was 71.1 nationally, which compares to a total of 57.9 days-of-supply on August 9, 2013.

According to the Energy Information Agency (EIA) for the week ending August 9, 2013, inventories were at 21.5 million. This year, Midwest propane inventories for the week ending August 8 are 23.4 million barrels. However, this year’s inventories are about 1.6 million barrels below the five-year average. Then again, the build is about six weeks from completion and, for the past six weeks in a row, weekly inventory builds have surpassed the weekly five-year average.

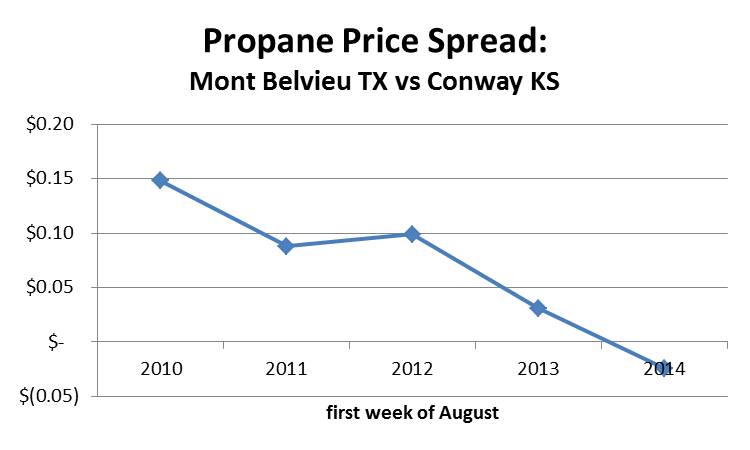

The current inventory build has been spurred by prices. EIA reports that for the first time in four years, prices not at peak demand season in the storage hub in Kansas have exceeded prices in the storage hub region of Texas. This is proving to be a strong incentive to keep inventories in the Midwest rather than be shipped to the Gulf Coast, which was what happened last year at this time. Moreover, stocks in Texas are high; they are above the five-year average.

The market is still somewhat dynamic. Storage has been lost in Ohio, a facility was closed last year after leaks were discovered and remains closed, and the Cochin Pipeline which served the Upper Midwest with propane from Canada last year has since been reversed and dedicated to other products than propane. However, according to EIA, the region overall has been adding infrastructure. There are new rail terminals for propane that have come on line and existing terminals have added tanks and storage capacity. EIA is predicting that more of the heating market in the Northeast will be supplied by imports from Canada and that the inventories in Kansas will be used to service the Upper Midwest in 2014-2015.