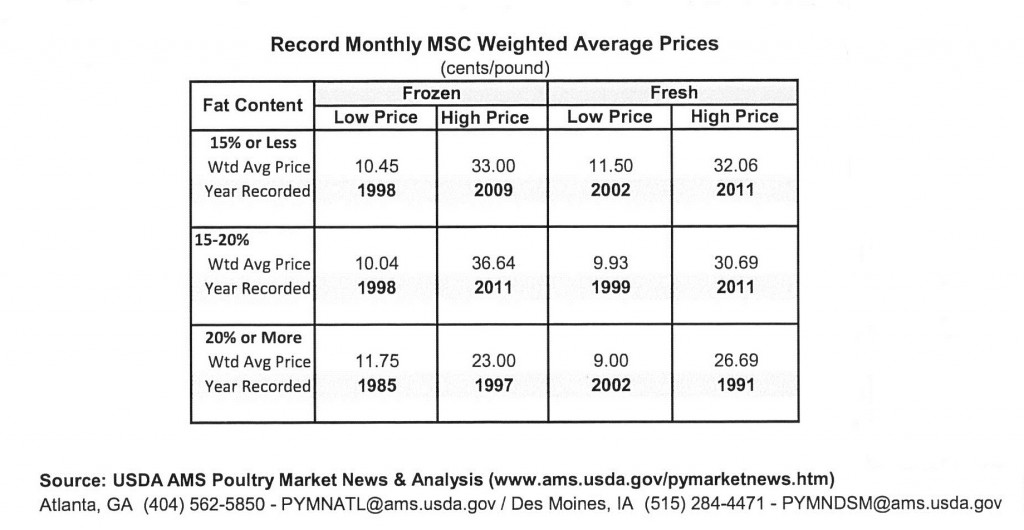

Mechanically separated chicken (MSC) experienced “record high pricing levels in 2011,” according to the “Processed Chicken: National Mechanically Separated Chicken” report, January 27, 2012 from USDA/AMS Poultry Market News & Analysis. “A tremendous amount of fluctuation has taken place” in the MSC marketplace in recent times, AMS reported. A chief influence of this volatility is the dynamic shifts in marketing that have increased marketplace challenges and created non-traditional trends, AMS explained. In the 30 years since the inception of the AMS MSC report, MSC set new record high prices in 2011 with “fresh 15 percent or less” reaching 32.06 F.O.B. and “fresh 15-20 percent” reaching 30.69 F.O.B. cents per pound, both occurring in September 2011. Also, “frozen 15-20 percent” reached 36.64 F.O.B. cents per pound in December 2011. Prior to 2011, the previous pricing high recorded for “fresh 15 percent or less” was 31.75 F.O.B. cents per pound in September 1983, for “fresh 15-20 percent” was 29.42 F.O.B. cents per pound in August 2005, and for “frozen 15-20 percent” was 30.61 F.O.B. cents per pound in April 2009. In addition, last fall saw one of the most difficult contract seasons, resulting in significantly higher price levels than in years past, quite possibly the highest in history, as well as the development of newer pricing strategies, AMS reported.

Since the economic downturn in 2008, the MSC marketplace has experienced a variety of pricing, supply, and demand shifts. Increased influence from new and existing sources are adding to the marketplace shifts. Influencing factors include record high grain costs, reduced MSC supplies in recent years (industry production adjustments, operations closings), reduced raw material availability, increased and expanded buyer competition, and the cost advantage of MSC in comparison to higher priced competing proteins. Further, factors involve the increased use of MSC by other sectors (biodiesel, animal fat, pet food), the current global economic recession, the recent shift in consumer purchases to more economical protein sources, and the growing demand for MSC into export channels. All of these contributing elements helped to create non-traditional trends and higher pricing for both spot and contractual trading, AMS concluded.

AMS reported the following data summary of low and high wholesale prices: