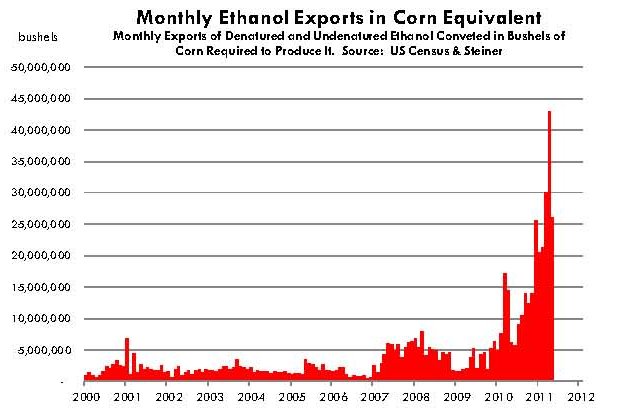

Demand for ethanol has increased since 2006 as a result of the renewable fuels standard mandate and because there has been an expanding export market for ethanol, according to the Daily Livestock Report (DLR) today. Higher fuel prices, a weak U.S. dollar, and mandates for renewable fuels in other countries have supported this export increase and will likely continue to bolster overseas demand, DLR explained.

For September 2010 through August 2011 (corn crop year) DLR estimated that over 770 million gallons of U.S. ethanol will be exported. This quantity is equivalent to 275 million bushels of corn. During September 2010 through May 2011 the two largest export markets for U.S. ethanol were Canada (26 percent of total) and Brazil (21 percent of total). DLR believes that high sugar prices, the strong Brazilian currency and very strong domestic demand in Brazil will limit Brazil’s competitiveness in the world ethanol market. This situation will favor the United States as a world supplier of ethanol and “further pressure very tight U.S. corn stocks”, DLR predicted.

For September 2010 through August 2011 (corn crop year) DLR estimated that over 770 million gallons of U.S. ethanol will be exported. This quantity is equivalent to 275 million bushels of corn. During September 2010 through May 2011 the two largest export markets for U.S. ethanol were Canada (26 percent of total) and Brazil (21 percent of total). DLR believes that high sugar prices, the strong Brazilian currency and very strong domestic demand in Brazil will limit Brazil’s competitiveness in the world ethanol market. This situation will favor the United States as a world supplier of ethanol and “further pressure very tight U.S. corn stocks”, DLR predicted.

In USDA’s World Agricultural Supply and Demand Estimates report this week, the average farm price for corn for 2011/12 is estimated to be between $5.50-$6.50 per bushel, down 50 cents per bushel on each end of the range from last month’s estimate. For 2010/11 USDA expects the average farm price for corn to be between $5.15-$5.35 per bushel. Ending corn stocks for 2011/12 are now estimated at 870 million bushels, up 175 million bushels from last month’s estimate and essentially the same level (880 million bushels) as seen for 2010/11. The stocks-to-use ratio for 2010/11 is 6.6 percent and for 2011/12 is 6.4 percent. In 2009/10 the comparable ratio was 13.1 percent.