The Brazilian Animal Protein Association (ABPA), which represents chicken and pork exporters in Brazil, estimates that chicken production there has been cut by 10 percent over the past three months. The cutbacks are due to a shortage of corn and dampened domestic consumer demand under the recessionary economy. Both large and small producers have employed production cutbacks, furloughs, lay-offs and shut downs to deal with the situation.

Source: CEPEA Brazil

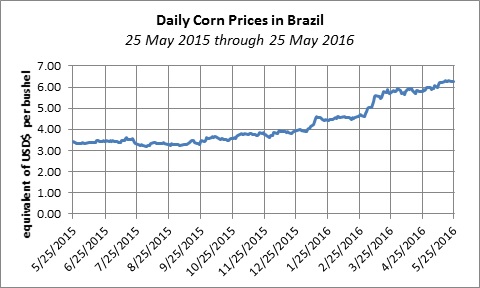

Brazil’s second-crop corn production was affected by dry weather. While the impact of the South American market has been felt in the United States with a rally in corn prices, it is a much larger issue in Brazil, especially when coupled with relatively low carryover stocks after aggressive exporting late last year by Brazil when the real was devalued.

The Government of Brazil is strategically releasing some corn stocks, but the volumes are not enough to maintain production at normal levels. Imports of corn from Argentina and Paraguay have increased and Brazil will likely have to continue importing corn through the marketing year. ABPA estimates that imports could increase to 1.5 million metric tons this year compared to last, which would be a five-fold increase. The corn shortage is driving up demand for feed wheat among chicken producers and wheat prices have also hit a two-year high in Brazil.

Brazil has been the largest chicken exporter since 2004 and last year exports hit a record level of 3.74 million metric tons driven by the devalued real. USDA’s Foreign Agricultural Service projected Brazilian chicken exports to grow by 6 percent in 2016, but that forecast is likely to be trimmed. While China will remain a top destination, Brazil’s traditional markets in the Middle East have a surplus supply from higher-than-usual imports last year, and Russia faces its own currency issues with a weak rubble.

Broiler production in Brazil was 13.1 million metric tons last year and early projections pegged 2016 production at 13.5 million metric tons. Based on ABPA’s estimate of a 10-percent cutback, production in 2016 could be as low as 12.15 million metric tons. That could equate to exports of 3.5-to-3.7 million metric tons instead of the 3.9 to 4.1 million metric tons projected for this year.